S&P 500 returns to halve in coming decade – Goldman Sachs. Financial Capability: The 2018 National Financial Capability Study. Retirement Topics - Exceptions to Tax on Early Distributions. Retirement Topics - IRA Contribution Limits. Gift-giving guilt: Nearly half of Americans have felt pressured to overspend during the holidays. Christmas or Retirement? Put Your Holiday Spending in Perspective. Although, most of it is distracting and not very useful. There’s more info available at your fingertips than ever before.

Roth ira calculator free#

It’s a free e-letter that’s packed with investing insight from market experts. To learn more about taxes and investing, sign up for Investment U below. And you shouldn’t have to pay Uncle Sam any more than you’re legally required to pay.

Roth ira calculator code#

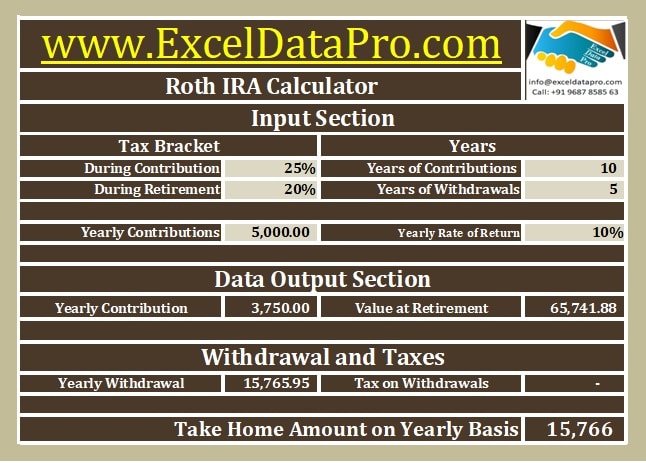

The tax code is complex but everyone plays by the same rules. So, it’s good you found this Roth IRA calculator. When it comes to building your nest egg, taxes have a huge impact. Also, there are high income limits for Roth IRAs and once again, that’s best to check directly with the IRS. And not everyone pulls in income each year. To contribute to IRAs, you need earned income from the year. On top of that, not everyone is able to make good use of this Roth IRA calculator. So, it’s best to check with the IRS for up-to-date limits. For example, it was a $5,500 limit in 2018. With inflation and other economic changes, this number changes over time. This is called a “catch-up” contribution and it brings the total to $7,000. If you’re 50 or older, you can contribute an additional $1,000. If you’re younger than 50, you can contribute $6,000 to a Roth IRA in 2022. And you can see this in the Roth IRA calculator above. This is where the big difference shows up compared to normal taxable accounts. The benefit to both of these accounts is that they grow tax free. And on the other hand… if you’re in a higher tax bracket today, it’s probably best to save in taxes by contributing to a traditional IRA. So if you think you’re in a lower tax bracket today than you’ll be in retirement, contributing to a Roth IRA makes more sense. Then when you withdraw down the road, you pay taxes. When you contribute funds, you don’t pay taxes. For traditional accounts this is reversed. Then in retirement when you withdraw funds, you don’t pay taxes. With Roth IRAs, you pay taxes in the year that you contribute funds. Although, the main difference between these retirement accounts is when the taxes occur. And traditional IRAs also have similar tax benefits. The Roth IRA calculator shows you how much you can save in taxes. It shows a graph as well but also gives you a table with each of the annual changes. This is also a good reminder that it’s important to start saving and investing sooner rather than later.įor another look at how your investments can grow, check out this free investment calculator. This factors in your investment returns and also compares to a taxable account.Īs you play around with the numbers, you’ll see that the longer the timeframe, the bigger the tax savings become. Then below that, the graph shows the change each year. Roth IRA Calculator Resultsīased on the numbers you enter, you’ll see your total contributions. Or if you want to compare to short-term capital gains, you can use the normal income tax brackets. For long-term capital gains, many people see a 15% tax rate. The Marginal Tax Rate depends on what tax bracket you’ll be in. If you have a portfolio with both bonds and stocks, the average will likely be lower. And stocks usually return 8-12% annually over the long-run. Traditional IRA and Roth IRA accounts to decide which is right for you. Both of these inputs help the Roth IRA calculator determine how long your portfolio will grow.įor the Expected Rate of Return, enter the average annual return that you expect. Our IRA calculator will help you compare the potential performance of different. The Current Age is your age today and Age at Retirement is when you expect to retire. If you contribute above the limit, you won’t see additional tax savings. And keep in mind that there are limits each year. With the Annual Contribution, enter the average amount you hope to add each year going forward. If you’re just starting out, this number should be zero. The Starting Balance is the current amount in your Roth IRA. The Roth vs Traditional IRA Calculator assumes you wont make any withdrawals from your Roth IRA for at least 5-years and none before age 59-1/2.

0 kommentar(er)

0 kommentar(er)